Bangko Sentral ng Pilipinas (BSP) visited Saint Louis University (SLU) for a discourse about new banking legislations– Financial Consumer Protection Act (FCPA) and Anti-Financial Account Scamming Act (AFASA)– in order to promote awareness among financial consumers on their rights and obligations under the law, particularly amidst growing fraud cases.

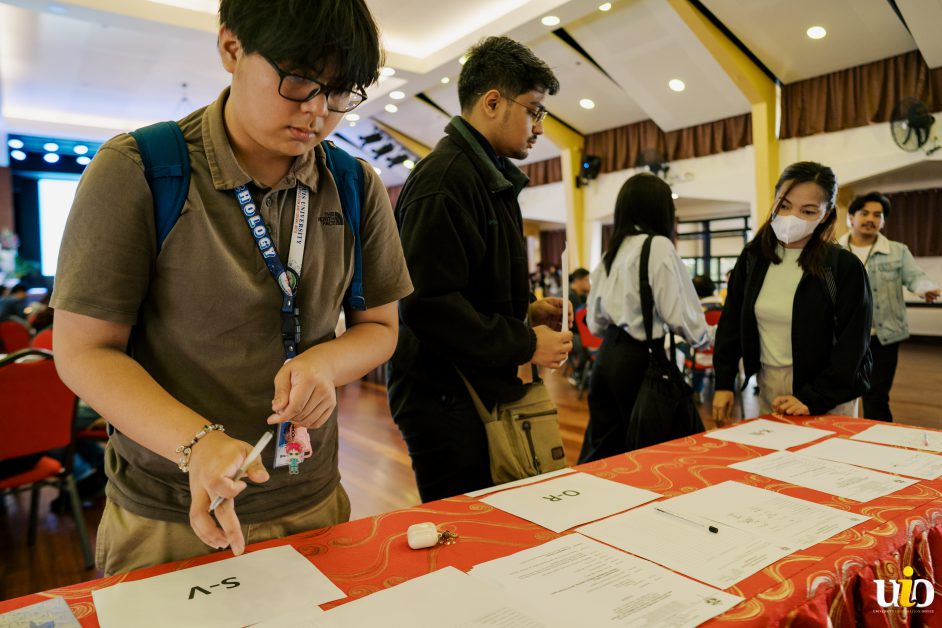

On 11 October 2024 at the Gevers Hall, SLU Main Campus, BSP Deputy Governor Elmore O. Capule discussed the aforementioned laws to SLU employees and students including Compliance Officers for Privacy (COP), law faculty and students, student publications staff, among others. Citing that the law is dynamic, Atty. Capule remarked, “With the passage of these two laws, it now became the power of the BSP to protect financial consumers.”

Atty. Capule initially discussed the mandates of the BSP, letting the attendees learn more about the country’s Central Bank and establishing the footing of FCPA and AFASA being the central points of the conference.

During the discussion on the statutes, the BSP Deputy Governor stated, “we change the law to fit the needs of the society,” as adjustments may continue to happen in the coming years with attentive considerations to the country’s economic conditions even including fluctuation.

The FCPA, or Republic Act No. 11765, essentially grants BSP authority over cases on financial scams, with the law covering all financial products or services offered or marketed by any financial service provider. Enacted in June 2022, the FCPA declares the “policy of the State to ensure that appropriate mechanisms are in place to protect the interest of consumers of financial products and services under the conditions of transparency, fair and sound market conduct, and fair, reasonable, and effective handling of financial consumer disputes, which are aligned with global best practices.”

Complementing FCPA is AFASA or Republic Act No. 12010, a proactive legislation enacted just last July to combat the increasing concern on cybercrime and financial account scams. Atty. Capule then tackled money muling and social engineering schemes which are penalized by the law.

The talk highlighted that financial scam and similar schemes may now be reported to, investigated and prosecuted by the Central Bank, with the BSP executive advising Louisians to be vigilant against financial frauds that are prevalent in both digital and physical avenues in the Philippines. After his lecture, the audience asked clarificatory questions.

In addition, the BSP, through Atty. Capule, donated “Banking Laws in the Philippines” books to the University Libraries and SOL Library essential for Louisians who wish to gain more knowledge about the financial consumer discussion that transpired in the talk.

The significant discourse led by BSP and SLU serves as an excellent standard of symposium in the SLU community, promoting awareness in the consumer protection aspects of banking laws and smart handling of personal information that are susceptible to financial scams. For more information on these laws, one may visit the official BSP website: www.bsp.gov.ph.

Through this event, SLU continues to champion the CICM Advocacy of Justice, Peace, and Integrity of Creation (JPIC) and pursue the United Nations Sustainable Development Goals (SDGs), particularly SDG 4 (Quality Education), SDG 8 (Decent Work and Economic Growth), and SDG 17 (Partnership for the Goals). (Article by Andreanna Martin, UIO Intern | Photos by Katrina Garcia, UIO Intern)